It’s December 2025. While the headlines about the “energy crisis” of a few years ago have faded, the reality for self-employed business owners remains stark: energy prices have settled at a “new normal”—and that normal is expensive.

As we close the books on 2025, every pound of overhead you save is a pound of profit you keep. If you work from home, your heating and electricity aren’t just household bills; they are business expenses that eat directly into your bottom line. Heating a three-bedroom house just to occupy a box room from 9 to 5 is, frankly, a terrible business model.

This isn’t a guide about installing solar panels or expensive heat pumps. It is a practical “audit” of low-cost hacks and behavioral tweaks you can implement today to protect your margins through Q1 2026.

1. Heat the Human, Not the Volume

The biggest waste of money in a home office is heating air that nobody is breathing. It costs significantly less to keep a body warm than it does to raise the ambient temperature of a 12ft x 12ft room (let alone the whole house).

- The Maths: A typical central heating boiler runs at roughly 24kW–30kW. Even if it’s only firing intermittently, that is a heavy load. In contrast, a modern electric heated throw or blanket uses around 100 watts (0.1kW).

- The Fix: Lower your central heating thermostat to 18°C (or off entirely in other rooms) and use a heated throw or an electric gilet.

- The Secret Weapon: If your hands get cold while typing, look into a heated desk mat. It warms your wrists and hands, which tricks your body into feeling warmer overall, keeping your productivity high without touching the thermostat.

2. “Smart” Zoning on a Budget

In late 2025, smart home technology is no longer a luxury; it’s a commodity tool for cost control.

- Smart Radiator Valves (TRVs): You don’t need to upgrade your whole system. Buying just one smart valve for your office radiator allows you to heat that room on a schedule (e.g., 8:30 AM – 5:30 PM) while keeping the kitchen and bedrooms cooler.

- The Vampire Hunt: Standby power drains money. Monitors, printers, and chargers left plugged in 24/7 are “vampire devices.”

- The Fix: Use a simple smart plug (available for roughly £10) for your main desk extension lead. Schedule it to perform a “hard kill” of power at 6:00 PM. Not only does this save electricity, but it also forces a better work-life balance by physically shutting down your office.

3. Low-Tech Insulation Wins

Drafts are the enemy of efficiency. If you are sitting near a window or a hallway door, you are likely losing heat faster than you can generate it.

- The “Sausage” Dog: It’s a cliché for a reason. A draft excluder at the base of your office door prevents the heat you have paid for from escaping into the hallway. It is arguably the highest ROI item you can buy this winter.

- Flooring: If your home office has laminate or wood flooring, you are losing heat through the ground. A thick, high-pile rug acts as insulation, trapping heat and stopping the “cold toe” syndrome.

4. The Lighting Audit (It’s Dark at 4 PM)

December means the lights are on by mid-afternoon. If you are still using old halogen bulbs in your desk lamps or overheads, swap them immediately for LEDs.

More importantly, switch to Task Lighting. There is rarely a need to light the entire ceiling of your office with a 1000-lumen bulb. A focused, low-wattage desk lamp creates a better working atmosphere, reduces eye strain, and costs a fraction of the price to run.

The Business Angle: What Can You Actually Claim?

Disclaimer: Not being an accountant, and tax rules can be complex. You should always verify your specific situation with your qualified accountant.

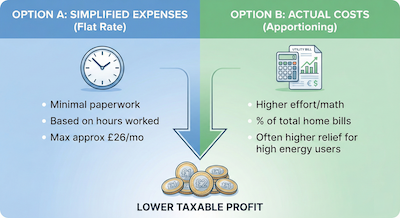

When you work from home as a sole trader or self-employed individual, HMRC allows you to claim tax relief on a portion of your household bills. However, how you claim it matters.

Option A: Simplified Expenses (The “Flat Rate”)

This is the easiest method and involves zero maths regarding your actual bills. You simply claim a flat monthly rate based on the hours you work at home:

- 25 to 50 hours: £10 per month

- 51 to 100 hours: £18 per month

- 101+ hours: £26 per month

** The Verdict:** For many full-time home workers in 2025, with energy prices where they are, £26 a month might be lower than your actual costs. This method saves time, but it might not save you the most tax.

Option B: Actual Costs (Apportioning)

This method requires more effort but is often more accurate for high energy users. You calculate the actual cost of running your home and claim a percentage based on:

- Area: How many rooms do you have, and how many does your office occupy? (e.g., 1 room out of 5 = 20%).

- Usage: What percentage of time is that room used for business?

If your gas and electric bill is £200 a month, and your office is 20% of your house, you might be able to claim £40 a month—significantly more than the flat rate.

A Note on Equipment vs. Clothing

If you rush out to buy the items mentioned in this blog, be careful with what you try to expense:

- Allowable: A dedicated electric heater or smart valve for the office is generally considered office equipment (Capital Allowances).

- Not Allowable: That heated gilet or warm jumper? HMRC usually views clothing as having a “dual purpose” (providing warmth and decency). Even if you only wear it at your desk, you could wear it to the shops, so it is generally not tax-deductible.

Conclusion

Saving £30 or £40 a month on energy might not sound life-changing, but over a year, that’s £360—enough to pay for a key software subscription or a client appreciation dinner.

Treat your home office energy usage with the same scrutiny you would treat a supplier invoice. If you wouldn’t overpay a supplier, don’t overpay your energy provider.

What is your favourite cold-weather WFH hack? Share it in the comments below—the best one gets a shout-out in our January blog!