Right, let’s have a wee blether about business insurance, shall we? It can be a right skelp to the wallet, especially when ye’re trying to keep a small business afloat. There’s a fair few types of cover out there, some ye have to have by law, like yer commercial motor insurance or Employer’s Liability, and others that just give ye a bit more peace of mind.

Just like yer home or car insurance, it pays to shop around for the best deal. Don’t just jump at the cheapest option though, mind. Ye need to make sure ye’ve got the right cover for yer business, and that depends on what ye do, how big ye are, and how ye operate.

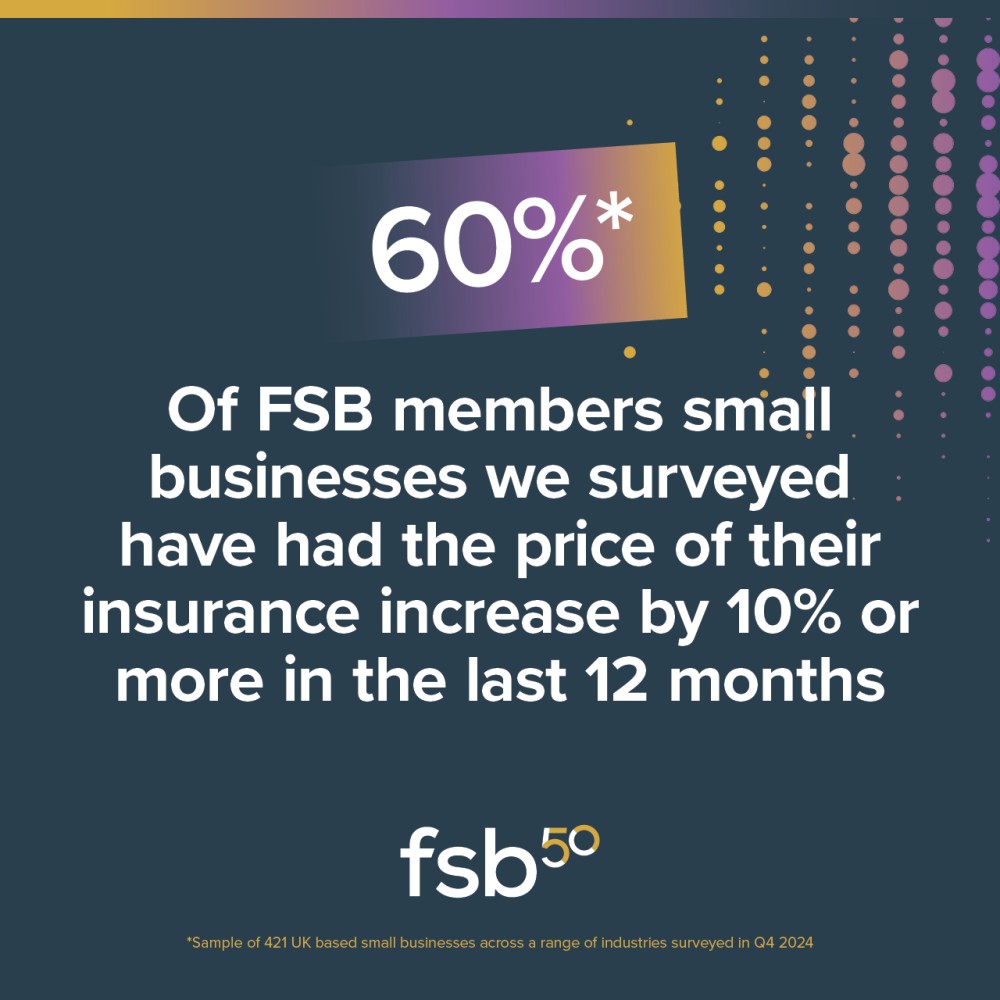

These days, with the cost of everything going up and the insurance market being a bit tight, it’s more important than ever to get good value for yer money. The folks at FSB Insurance Service have some canny advice – five questions to ask yourself to make sure ye’re protecting yer bottom line – and yer business.

- What does yer insurer need to ken? The price ye pay depends on a few things, like the type and amount of cover, any claims ye’ve made before, and the excess ye choose. When ye’re getting a quote, be as detailed as ye can, and tell them exactly what yer business does. Be accurate and don’t forget any changes ye’ve made, like taking on staff or moving premises. If ye’re just starting out, there are guides to setting up business insurance. Different insurers might ask for different things, so get all yer paperwork sorted beforehand. It’ll make things quicker.

- What makes ye a well-run business? Showing yer insurer that ye’re a well-run outfit with a risk management strategy can help ye get better premiums. Tell them about things like: How ye manage health and safety, any training ye or yer team have done (CPD certified training, whether it’s food hygiene or fire safety, shows ye’re serious about safety), whether ye have a Business Continuity Plan, and what security measures ye have in place, like alarms, CCTV, data privacy policies, and anti-virus software.

- What protections have ye put in place? If ye’ve had a claim before, explain what ye’ve done to stop it happening again. This could include things like extra flood protection (flood-resistant upgrades, moving equipment higher up, a flood plan), extra security (locks, cameras), or resilient repairs (moving electrical sockets higher, using floor tiles instead of carpet).

- Could ye consider a higher excess? A higher excess means ye’d pay more yourself if there’s a claim. Think carefully about the risk ye’re willing to take. Get some professional advice on this, a good broker will be able to help.

- Are ye getting the right cover for the right price? Don’t just go for the cheapest option if it means yer claim won’t be paid. That’s called underinsurance, and it’s a growing problem. Always review yer policies when they’re up for renewal.

Getting advice from an insurance broker is the best way to make sure ye’ve got the right protection. FSB members can register with FSB Insurance Service and get free insurance advice. Don’t be shy, it’s yer business we’re talking about!

Give Glenn Cameron a shout – he’s our Membership Advisor – and he’ll connect ye with the right folks if ye’re already a member. And if ye’re not a member yet, well, what are ye waiting for? Get yersel’ on board and see about getting the best value insurance for ye and yer business. Glenn’ll sort ye out.